Delve into the world of market trading strategies for high returns with this comprehensive guide. Learn about the key components, successful examples, and benefits of implementing a solid trading strategy to maximize your profits.

Overview of Market Trading Strategies

Having a well-defined trading strategy is crucial in the world of market trading. It provides a clear roadmap for making decisions, managing risks, and maximizing profits. Without a solid strategy, traders are more likely to make impulsive decisions based on emotions or short-term market fluctuations.

Professional traders often rely on proven strategies that have consistently delivered high returns. These strategies are based on thorough research, analysis of market trends, and a deep understanding of various trading instruments.

Successful Market Trading Strategies

- Day Trading: This strategy involves buying and selling financial instruments within the same trading day to capitalize on short-term price movements.

- Trend Following: Traders using this strategy aim to identify and follow prevailing market trends to ride the momentum and profit from sustained price movements.

- Range Trading: This strategy involves identifying key support and resistance levels to trade within a defined price range, buying at the bottom and selling at the top.

Key Components of an Effective Trading Strategy

- Risk Management: Implementing proper risk management techniques to protect capital and minimize losses.

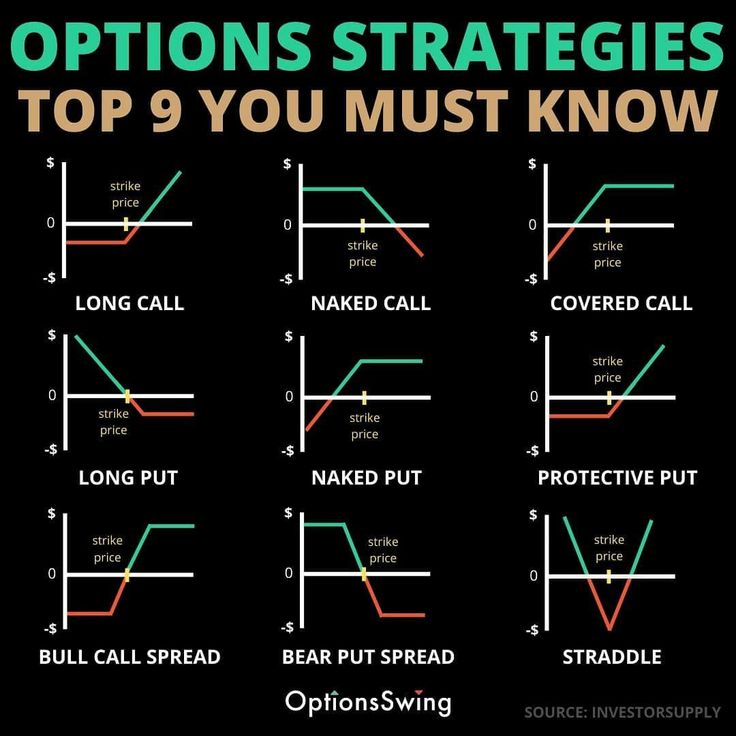

- Technical Analysis: Using charts, indicators, and patterns to make informed trading decisions based on historical price movements.

- Entry and Exit Points: Identifying strategic entry and exit points for trades to maximize profits and minimize losses.

Benefits of Implementing a Solid Trading Strategy

- Consistency: A well-defined strategy helps traders maintain discipline and consistency in their trading approach.

- Profitability: By following a proven strategy, traders can increase their chances of making profitable trades and achieving high returns.

- Reduced Emotional Bias: Having a clear strategy in place reduces the impact of emotions on trading decisions, leading to more rational and calculated choices.

Fundamental Analysis Strategies

Fundamental analysis plays a crucial role in determining market trends by focusing on the intrinsic value of an asset. It involves analyzing various economic, financial, and qualitative factors that can influence the price of a security.

Role of Fundamental Analysis in Trading

Fundamental analysis tools are used to assess the financial health and performance of a company. Some common tools include:

- Financial statements analysis

- Ratio analysis

- Economic indicators

- Industry trends

Comparison of Fundamental Analysis Strategies

Different fundamental analysis strategies include value investing, growth investing, and income investing. Each strategy focuses on different aspects of a company's fundamentals and can impact trading decisions in various ways. Value investors look for undervalued stocks, growth investors focus on companies with potential for high earnings growth, and income investors seek stocks with stable dividends.

Integrating Fundamental Analysis into Trading Strategy

To maximize the effectiveness of fundamental analysis, traders should combine it with technical analysis and market sentiment. By incorporating fundamental analysis into their trading strategy, traders can make more informed decisions based on a comprehensive understanding of the market and the underlying factors driving asset prices.

Technical Analysis Strategies

Technical analysis is a method used by traders to evaluate investments and identify trading opportunities based on statistical trends gathered from trading activity, such as price movement and volume. It focuses on studying historical data to predict future price movements and market trends.

Popular Technical Analysis Indicators

Technical analysis indicators are tools used by traders to analyze market data and make informed trading decisions. Some popular indicators include:

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

- MACD (Moving Average Convergence Divergence)

Interpreting Technical Analysis Charts

Technical analysis charts display historical price data and trading volumes in graphical form. Traders use these charts to identify patterns and trends that can help predict future price movements. For example, an upward trend may indicate a potential buying opportunity, while a downward trend may signal a selling opportunity.

Incorporating Technical Analysis Strategies

To incorporate technical analysis into your trading approach, follow these steps:

- Choose the right technical analysis indicators based on your trading goals and preferences.

- Study historical price data and analyze charts to identify patterns and trends.

- Use technical analysis indicators to confirm signals and make informed trading decisions.

- Regularly review and adjust your technical analysis strategies based on market conditions and performance.

Risk Management Techniques

Risk management is a crucial aspect of market trading, especially when aiming for high returns. By implementing effective risk management techniques, traders can protect their investments, control risk exposure, and ultimately safeguard their capital while maximizing returns.

Setting Stop-Loss Orders

Setting stop-loss orders is a common strategy used by traders to limit potential losses. By defining a predetermined price at which a trade will be automatically closed, traders can protect their investments from significant downturns. It is essential to set stop-loss orders based on careful analysis of market conditions and individual risk tolerance levels.

Position Sizing Methods

Position sizing methods play a key role in controlling risk exposure. By determining the appropriate amount of capital to allocate to each trade based on factors such as account size, risk tolerance, and market volatility, traders can effectively manage the level of risk in their portfolio.

Common position sizing methods include the fixed percentage method and the volatility-adjusted method.

Risk Management Plan

Creating a comprehensive risk management plan is essential for traders looking to navigate the uncertainties of the market successfully. A well-defined risk management plan should Artikel clear guidelines for setting stop-loss orders, determining position sizes, and managing overall risk exposure.

By adhering to a structured risk management plan, traders can protect their capital while pursuing high returns in the market.

Concluding Remarks

In conclusion, mastering the art of market trading strategies is essential for achieving high returns in the dynamic world of finance. With the right approach and tools, you can navigate the markets with confidence and precision.

FAQ Corner

What is the importance of having a well-defined trading strategy?

Having a well-defined trading strategy provides clarity, direction, and discipline in your trading decisions, leading to better chances of success and higher returns.

How can fundamental analysis be integrated into trading strategies?

Fundamental analysis can be integrated by using tools like financial statements, economic indicators, and industry reports to assess the intrinsic value of assets and make informed trading decisions.

Why is risk management crucial in market trading?

Risk management is vital to protect your capital from significant losses and ensure long-term profitability by controlling risk exposure and setting stop-loss orders.