Commodity Market Trends: Latest Insights & Forecasts sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the dynamic world of commodity market trends, we uncover a fascinating landscape shaped by various factors and forces.

Overview of Commodity Market Trends

A commodity market trend refers to the general direction in which prices of commodities are moving over a certain period of time. This trend can be influenced by various factors and has a significant impact on the global economy.

Significance of Monitoring Commodity Market Trends

Monitoring commodity market trends is crucial for investors, traders, and policymakers to make informed decisions. Understanding the direction in which commodity prices are moving can help in predicting future price movements and identifying potential risks and opportunities.

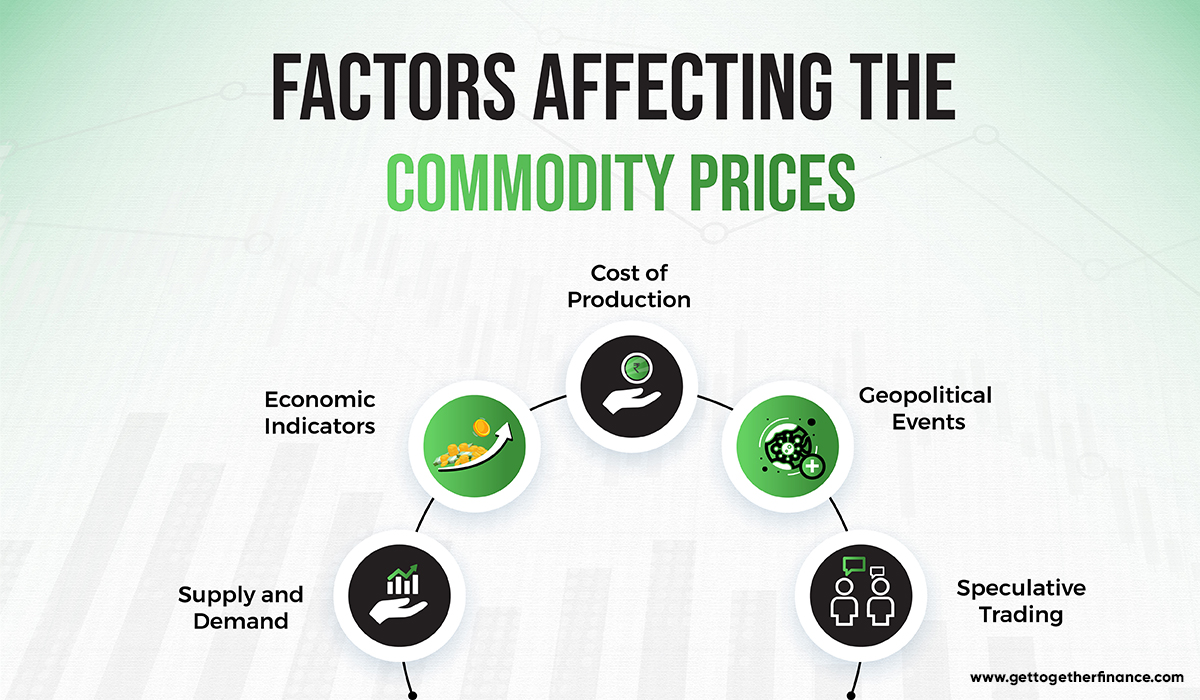

Factors Influencing Commodity Market Trends

- Supply and Demand: The fundamental principle of supply and demand plays a major role in determining commodity prices. Any imbalance between supply and demand can lead to price fluctuations.

- Geopolitical Events: Political instability, wars, trade agreements, and sanctions can impact commodity prices by disrupting supply chains or affecting demand.

- Weather Conditions: Natural disasters like droughts, floods, or hurricanes can affect the production and supply of agricultural commodities, leading to price fluctuations.

- Economic Indicators: Factors such as interest rates, inflation, and GDP growth can influence commodity prices as they impact global economic conditions and consumer demand.

Types of Commodities Traded

Commodities traded in the market can be broadly categorized into three main types: agricultural, energy, and metals.

Agricultural Commodities

- Examples: wheat, corn, soybeans, coffee, sugar

- Description: These commodities are derived from agriculture and are influenced by factors such as weather conditions, crop yields, and government policies.

Energy Commodities

- Examples: crude oil, natural gas, gasoline

- Description: Energy commodities are crucial for the functioning of economies and are greatly impacted by geopolitical events, supply-demand dynamics, and technological advancements.

Metals Commodities

- Examples: gold, silver, copper, platinum

- Description: Metals commodities are often seen as safe-haven assets and are influenced by factors such as industrial demand, global economic conditions, and currency fluctuations.

When it comes to volatility levels, energy commodities tend to exhibit higher levels of volatility compared to agricultural and metals commodities. This is due to the sensitivity of energy prices to geopolitical tensions, supply disruptions, and global demand fluctuations.

Geopolitical events play a significant role in impacting the trading of various commodities. For example, political instability in oil-producing regions can lead to supply disruptions and price spikes in crude oil. Similarly, trade disputes between countries can affect the prices of agricultural commodities due to changes in tariffs and export-import policies.

Recent Developments in Commodity Markets

In recent years, the commodity market has witnessed several noteworthy developments that have reshaped the landscape of trading. These changes have been influenced by various factors, including technological advancements, sustainability practices, and global economic shifts.

Impact of Technology on Commodity Market Trends

Technology has played a significant role in transforming commodity trading practices. The introduction of electronic trading platforms has made it easier for market participants to buy and sell commodities at a faster pace. Automated trading algorithms have also become increasingly popular, allowing for more efficient and precise trading decisions.

Additionally, the use of big data analytics has provided traders with valuable insights into market trends and price movements, enabling them to make more informed decisions.

Influence of Sustainability Practices on Commodity Prices

The growing emphasis on sustainability and environmental responsibility has had a profound impact on commodity prices. Consumers are increasingly demanding ethically sourced and environmentally friendly products, leading companies to adopt sustainable practices throughout their supply chains. As a result, commodities that are produced in a sustainable manner often command higher prices in the market.

This shift towards sustainability has forced commodity producers to rethink their production processes and implement more eco-friendly practices to remain competitive in the market.

Key Trends in Commodity Trading

- The rise of alternative investments such as renewable energy sources and carbon credits.

- Increasing focus on ESG (Environmental, Social, and Governance) criteria in commodity trading decisions.

- Integration of blockchain technology for transparent and secure commodity transactions.

- Impact of geopolitical factors on commodity prices and supply chains.

- Growing demand for rare earth metals and minerals due to advancements in technology.

Regional Trends in Commodity Markets

Regional variations play a significant role in shaping commodity market trends. Different regions around the world have unique factors influencing commodity prices and production. Let's explore some key insights into regional trends in commodity markets.

Key Regions Driving Changes in Commodity Prices

Understanding the impact of key regions on commodity prices is crucial for market analysis and forecasting. Here are some regions that play a pivotal role in driving changes in commodity prices:

- The Middle East: A major exporter of oil, the Middle East's political stability and production levels greatly influence global oil prices.

- Asia-Pacific: With a growing demand for commodities like metals and agricultural products, the Asia-Pacific region significantly impacts global commodity prices.

- Latin America: Rich in natural resources, Latin America's commodity exports have a substantial impact on the global market, particularly in areas like agriculture and mining.

Climate Change Effects on Commodity Production

Climate change is a critical factor affecting commodity production in various regions. Changes in weather patterns, natural disasters, and shifting agricultural conditions have significant implications for commodity markets. Here are some examples of how climate change is impacting commodity production:

- Extreme Weather Events: Unpredictable weather patterns can lead to crop failures, affecting agricultural commodity prices in regions like North America and Africa.

- Water Scarcity: Droughts and water shortages impact commodity production in regions like Australia and parts of Europe, leading to price fluctuations in crops like wheat and vegetables.

- Rising Temperatures: Increasing temperatures can affect the production of commodities like coffee and cocoa in regions such as South America, impacting global supply chains.

Conclusive Thoughts

In conclusion, the exploration of Commodity Market Trends: Latest Insights & Forecasts unveils a complex ecosystem where trends, developments, and regional variations converge to define the future of commodity trading.

Q&A

What are commodity market trends?

Commodity market trends refer to the direction in which prices of various commodities are moving, influenced by factors like supply, demand, and geopolitical events.

Why is it important to monitor commodity market trends?

Monitoring commodity market trends helps investors and traders make informed decisions, anticipate price movements, and manage risks effectively.

How do geopolitical events impact commodity trading?

Geopolitical events can disrupt commodity supplies, create uncertainty in markets, and lead to price fluctuations based on geopolitical tensions or policies.