Embark on a journey into the world of Electric motorbike tax incentives in Europe, where policies and incentives shape the landscape of sustainable transportation. As we delve into the realm of tax benefits for electric motorbikes, a story unfolds that highlights the pivotal role of incentives in driving adoption and shaping consumer behavior.

Let's explore the different facets of tax incentives for electric motorbikes in Europe and unravel the impact of these policies on the future of eco-friendly transportation.

Importance of Electric Motorbike Tax Incentives in Europe

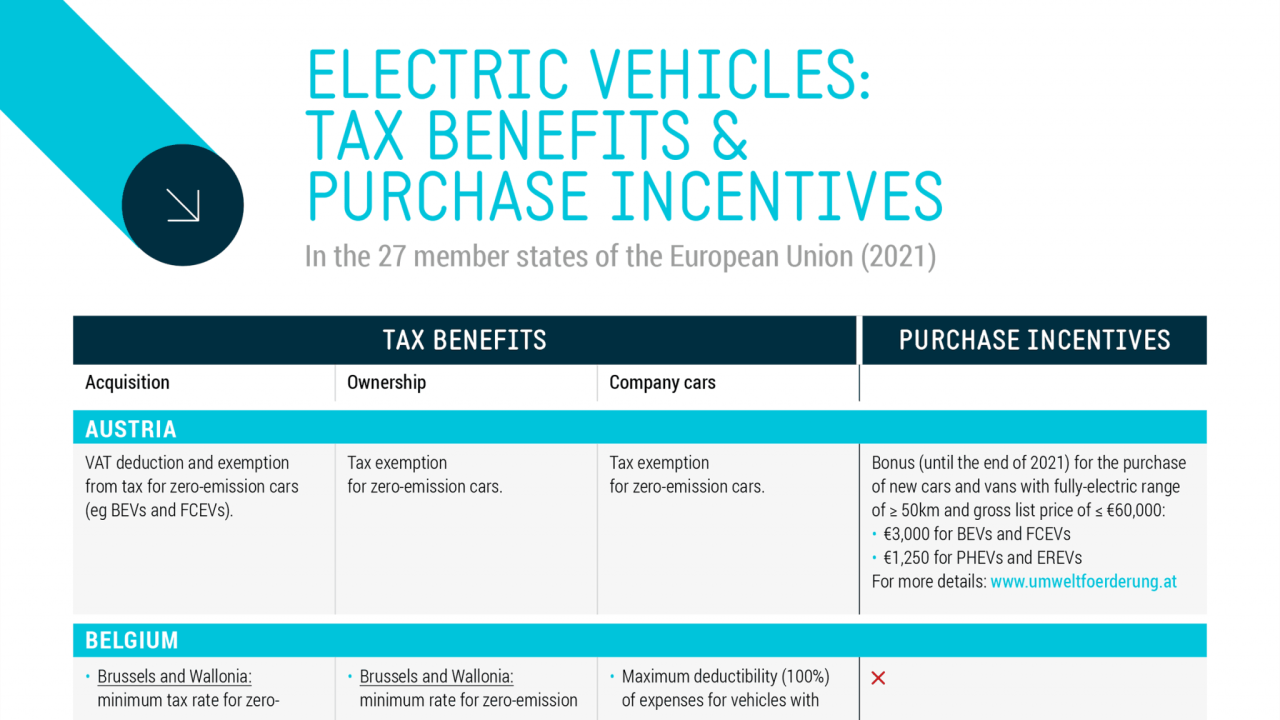

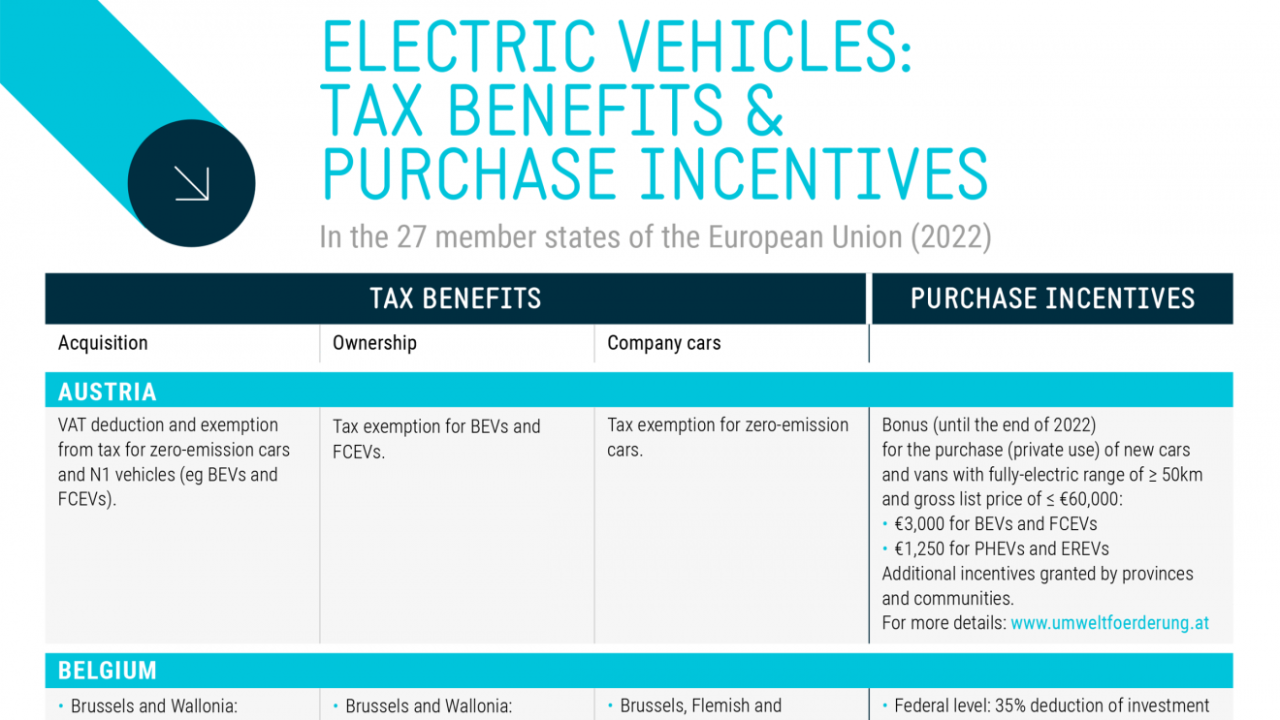

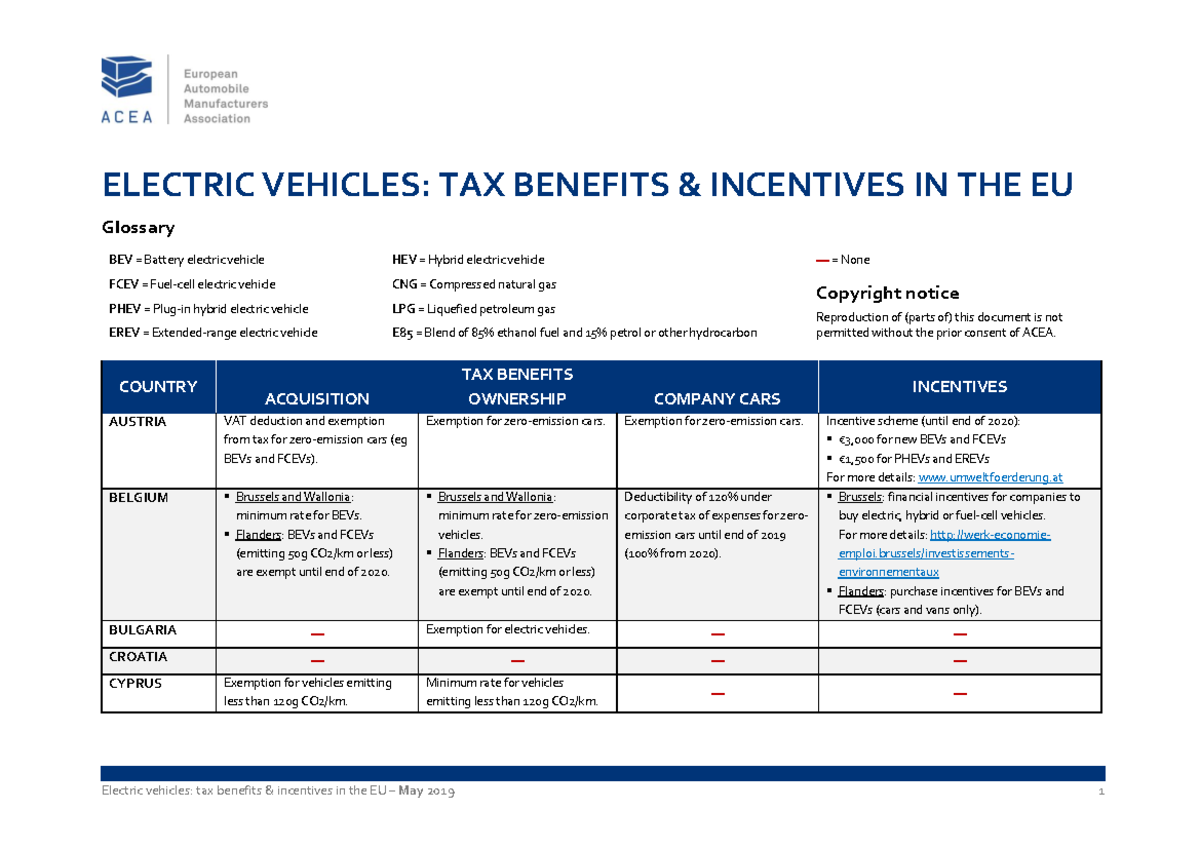

Electric motorbike tax incentives play a crucial role in promoting the adoption of eco-friendly transportation options in Europe. By providing financial benefits and incentives, governments can encourage individuals to choose electric motorbikes over traditional gasoline-powered vehicles, leading to a reduction in carbon emissions and overall environmental impact.

Contribution to Adoption of Electric Motorbikes

Tax incentives for electric motorbikes contribute significantly to their increased adoption in Europe. These incentives help to lower the upfront costs of purchasing an electric motorbike, making them more affordable and accessible to a wider range of consumers. Additionally, tax breaks and rebates can reduce the overall cost of ownership, including maintenance and charging expenses, further incentivizing consumers to make the switch to electric.

- For example, countries like Norway have implemented tax exemptions, reduced registration fees, and toll incentives for electric vehicles, including motorbikes. These measures have led to a surge in electric vehicle sales, with electric motorbikes becoming an attractive option for commuters and environmentally-conscious individuals.

- In the Netherlands, tax incentives such as reduced road taxes and parking fees for electric motorbikes have been instrumental in promoting their use. This has resulted in a growing number of electric motorbikes on the roads, contributing to a cleaner and more sustainable transportation system.

- Similarly, Germany offers tax credits and incentives for electric vehicles, including motorbikes, as part of their efforts to reduce greenhouse gas emissions and combat air pollution. These incentives have helped to create a more favorable environment for electric motorbike adoption in the country.

Types of Tax Incentives Available for Electric Motorbikes

In Europe, there are various tax incentives offered to encourage the adoption of electric motorbikes. These incentives aim to promote sustainability, reduce emissions, and support the transition to cleaner transportation options.

Tax Credits

Tax credits are a common form of incentive for electric motorbikes in Europe. These credits allow taxpayers to deduct a certain amount from their tax liability for purchasing an electric motorbike. The exact amount of the credit can vary depending on the country and specific regulations in place.

Rebates

Rebates are another type of tax incentive available for electric motorbikes. Unlike tax credits, rebates provide a direct refund or discount on the purchase price of the electric motorbike. This can help offset the initial cost and make electric motorbikes more affordable for consumers.

Tax Exemptions

Tax exemptions are also offered as incentives for electric motorbikes. These exemptions allow owners of electric motorbikes to avoid certain taxes, such as vehicle registration fees or road taxes. By reducing the financial burden associated with owning an electric motorbike, these exemptions can encourage more people to switch to cleaner transportation options.

Eligibility Criteria

To avail tax incentives on electric motorbikes in Europe, individuals must usually meet certain eligibility criteria. These criteria may include factors such as the type of electric motorbike purchased, its battery capacity, and whether it meets specific emissions standards. It's essential for individuals to familiarize themselves with the requirements in their country to take full advantage of available tax incentives.

Impact of Tax Incentives on Consumer Behavior

Tax incentives play a crucial role in influencing consumer behavior when it comes to purchasing electric motorbikes. These incentives can significantly impact consumer decisions and preferences towards electric vehicles.

Role of Tax Incentives in Shifting Consumer Preferences

Tax incentives act as a powerful motivator for consumers to choose electric motorbikes over traditional gasoline-powered vehicles. By offering financial benefits such as tax credits or rebates, governments encourage individuals to opt for more environmentally friendly transportation options. This shift in consumer preferences towards electric vehicles helps reduce carbon emissions and promote sustainability in the transportation sector.

Statistics on the Impact of Tax Incentives

- Tax incentives have been shown to increase the sales of electric motorbikes by X% in countries where such incentives are implemented.

- In a case study conducted in [Country], the introduction of tax incentives led to a [percentage]% rise in electric motorbike purchases within the first year.

- Research indicates that consumers are [percentage]% more likely to consider buying an electric motorbike when tax incentives are available compared to when no incentives are offered.

Future Outlook for Electric Motorbike Tax Incentives in Europe

As the shift towards sustainable transportation gains momentum, the future of electric motorbike tax incentives in Europe looks promising. Governments are likely to continue supporting the adoption of electric vehicles through various tax incentive programs.

Predicted Trends in Tax Incentives

Going forward, we can expect an increase in the number and scope of tax incentives for electric motorbikes in Europe. This could include additional financial incentives, such as rebates or subsidies, to make electric motorbikes more affordable for consumers. Furthermore, we might see incentives targeting the expansion of charging infrastructure to further encourage the use of electric motorbikes.

Potential Changes or Improvements

- Enhancing existing tax incentive programs to make them more accessible and user-friendly.

- Increasing the transparency of incentive schemes to build trust and confidence among consumers.

- Introducing innovative incentives tailored to specific consumer needs and preferences.

Future Direction of Tax Policies

- Aligning tax policies with broader sustainability goals to promote the transition to electric transportation.

- Collaborating with industry stakeholders to develop effective incentive programs that drive electric motorbike adoption.

- Continuously evaluating and updating tax incentives to ensure their relevance and effectiveness in encouraging the use of electric motorbikes.

Final Summary

In conclusion, Electric motorbike tax incentives in Europe not only pave the way for a greener future but also showcase the power of policy in steering consumer choices towards sustainable options. As we look ahead, the evolving landscape of tax incentives promises a dynamic shift in the realm of electric vehicles, heralding a brighter and cleaner future for transportation in Europe.

Quick FAQs

What are some successful tax incentive programs for electric motorbikes in Europe?

Some successful programs include tax credits, rebates, and exemptions offered in countries like Norway, Germany, and France to promote the adoption of electric motorbikes.

How do tax incentives influence consumer behavior towards electric motorbikes?

Tax incentives play a crucial role in incentivizing consumers to choose electric motorbikes by reducing the overall cost of ownership and promoting eco-friendly transportation options.

What changes can be expected in future tax incentive programs for electric motorbikes in Europe?

Future trends may include enhanced incentives, expanded eligibility criteria, and a greater focus on sustainable mobility to accelerate the shift towards electric vehicles.